Wondering why we’ve made arrangements to encourage investing with Inspire Advisors? Read the latest from CEO Robert Netzly: 7 Critical Ways Inspire Investing Is Pushing Back ESG

If you like what you’re reading, call Matt & Drew at Inspire. They’ll run a FREE, no strings attached Impact Report for you, to get you started on your journey to Defund the Woke.

Background:

I stumbled upon Inspire Advisors via a mutual friend and was thrilled to find Inspire Insights <take a moment to open a new page and check that out>. Liking what I found on their website, I contacted their marketing team and started making new friends immediately. The folks at Inspire are refreshingly different! Very much like stumbling upon old-school Journalism (which is sorely lacking today), the people I’ve spoken with at Inspire genuinely care and are not afraid to ask the important questions.

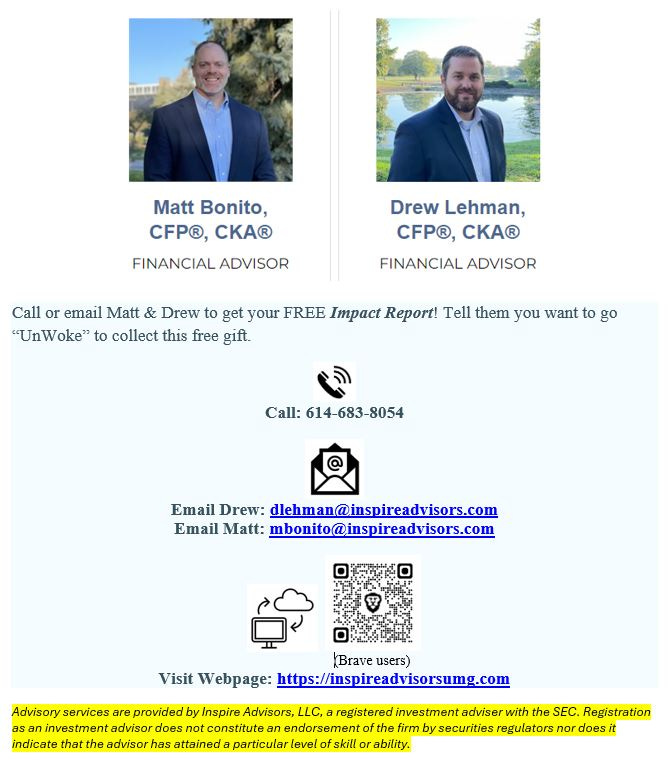

My initial contact quickly lead to an introduction to Financial Advisors Matt & Drew who I recommend contacting. Call them today to get started on your journey toward Defunding the Woke… or, as we like to say: DIS the Globalist/Left; know where you Donate, Invest, and Spend.

Matt & Drew are offering to do a FREE, no strings attached, Impact Report for anyone who mentions “UnWoke” when you contact them. As an added bonus, anyone who does like them and ends up working with Matt & Drew is helping, indirectly, to keep UnWoke.Academy alive and well - we’ve arranged for a small bit of their revenue to come back to pay UnWoke Founder Jonathan Broadbent, who worked to wind-down his Financial Advisory firm after 28 months of attacks from Weaponized Regulators, in order to continue to report on the “woke” in Wall Street and research better alternatives.

NOTE 1: We’re working on getting CEO Robert Netzly as a guest on the UnWoke.Academy podcast. Stay tuned…

NOTE 2: The primary motivation behind finding and choosing to work with Inspire is their defined research. Too much of what now constitutes woke-Left investment due diligence is corrupted and ill-defined. “ESG”, “CRT/DEI”, the corporate-profit-at-all-costs, Big-Box structure of many large financial firms, and supposed “green initiatives” and their associated Federal grant dollars, along with undue pressure from Globalist “Corporate Equity Index”, artificially manipulate markets, often pressuring money into bad investments. Having clearly defined investment due diligence parameters is refreshing and needed!

P.S.: WOW! This post saw a 2,000% increase in the number of downloads! Note to self: do more podcasts like this one.

UnWoke Ep. 89: Get INTO Your Comfort Zone

Financial Planning for those wanting to go UnWoke (my term, not theirs… they just never gave in to the woke-Left):