In case you hadn’t heard “Costco shareholders voted to keep DEI”.

But there’s a lot more to the story. Start with key questions. Who actually voted for Costco to continue its DEI program? And who voted in the board members who advocated for it in the first place? The answers may surprise you.

In brief, if you have investments somewhere, like an IRA or 401(k) but don’t get notices in the mail about important events and votes, then the chances are good that someone else gets to vote on your behalf. In theory, these companies are supposed to be objective and neutral. But what if they’re not?…

While Globalist-Leftists work to spread the message that racism is okay, (“see, look, Costco shareholders voted for it…”) UnWoke.Academy chose to take a different approach. Let’s find the facts…

First, everyone should know that many managed investments, like mutual funds, invest in Costco stock. If you have a 401(k) Plan or IRA, or similar investments, that you let someone else manage on your behalf (we’re looking at you, Blackrock), then you may own some Costco stock and not even know it. This means that you may well have a vote in things like DEI at Costco. But if it wasn’t you who cast votes in favor of systemic racism at Costco Wholesale, who did?

That’s where Proxy Voting comes in. According to Investopedia:

Proxy Voting “refers to a ballot cast by a single person or firm on behalf of a corporation's shareholder who may not be able to attend a shareholder meeting, or who may not choose to vote on a particular issue.”

(Source: https://www.investopedia.com/terms/p/proxy-vote.asp)

The chances are very good that either Glass Lewis, based out of San Francisco California, or ISS, based out of Frankfurt Germany (or both) had a hand in shaping this outcome. “But who are they?”, you might ask. Let’s start with ISS…

(Those are links, by the way, so you should feel free to explore their websites and see how woke they are for yourself.)

ISS stands for Institutional Shareholder Services. Here’s a web search for “ISS Proxy Adviser”.

Before the first mouse-click, we can see the woke. Think of “ESG” like Green New Deal, except forced upon companies instead of the original approach of pitching it to We The People. It stands for Environmental, Social, & Governance, and is the single greatest reason UnWoke was formed. It’s a backdoor way of forcing the Green New Deal agenda that the world decided we don’t want. Except ESG is even worse, because it also includes racism and all sorts of extra things like gender-theory and sexuality components.

Here’s a Whitehouse Memo from January 21, 2025 that addresses “Terminating The Green New Deal”, in keeping with public sentiment.

People of all nations rejected the climate agenda. ESG is a means of forcing it upon us anyway, by forcing the companies that serve us to force-change everything about our lives. But back to its counterpart, DEI, which is based upon Critical Race Theory, and how it too is being forced upon us by corporate behavior…

ISS is majority owned by Deutsche Börse Group, according to their website. Here’s more on Deutsche Börse Group, according to Wikipedia:

Deutsche Börse AG (German pronunciation: [ˈdɔʏtʃə ˈbœʁzə]), or the Deutsche Börse Group, is a German multinational corporation that offers a marketplace for organizing the trading of shares and other securities. It is also a transaction services provider, giving companies and investors access to global capital markets. It is a joint stock company and was founded in 1992, with headquarters in Frankfurt. On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative.[3] It is the third-largest stock market in Europe by market cap after Euronext Paris and the London Stock Exchange.

This means that while the United States is exiting “climate agreements”, long after the Green New Deal was resoundingly rejected, and amid calls for the United States to exit the United Nations… a German company with strong ties to the United Nations, “Sustainable”, and “ESG” is Proxy Voting hundreds of millions, perhaps billions of votes. They are establishing Boards of Directors and deciding upon things like whether or not Costco is going to continue a race-based agenda.

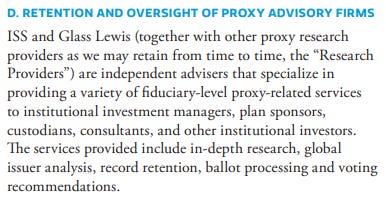

NOTE: as of this writing, it is unclear ISS’s exact role in the Costco DEI matter. We are researching the total influence they may have had upon Costco as a whole and upon this particular issue. ISS and Glass Lewis, based in San Fransicso California, are among the largest Proxy Vote Advisers in the world. Determining which does what is difficult because they operate behind other companies, like Wall Street firms Morgan Stanley, UBS, and others (see below for more details).

How did companies like ISS and Glass Lewis (by some accounts, amounting to around 90% of Proxy Voting) get to be so big and influence such world-important things like the Boards of Directors of major multi-national companies? Simple: they marketed themselves to places like “Wall Street” as a go-to compliance resource, offering to vote all those un-voted shares hiding in plain sight in things like mutual funds.

Here’s ISS on “Intermediary Outsource Solutions”, marketing themselves as a global resource for global governance to financial institutions.

So, who ultimately owns all those voting shares of Costco? Who are the shareholders who “voted” to keep racist and highly problematic CRT/DEI? Indirectly, We The People did… by allowing other people to vote our shares, and then allowing those companies to move far-Left, unchecked.

Among the largest institutional investors in Costco are: Blackrock, iShares (which is owned by Blackrock), Vanguard, Fidelity, State Street, and others. According to this report from Morningstar, Blackrock alone owns at least 9.7 million shares (as of the most recent Morningstar reporting).

Who sub-contracts to ISS or Glass Lewis?

Morgan Stanley

UBS

Source: https://www.ubs.com/global/en/assetmanagement/insights/thematic-viewpoints/sustainable-impact-investing/articles/aligning-activities/_jcr_content/mainpar/toplevelgrid_274723673/col1/linklist/link_2102052751.0089423658.file/PS9jb250ZW50L2RhbS9hc3NldHMvYW0vZ2xvYmFsL2luc2lnaHRzL3N1c3RhaW5hYmxlLWFuZC1pbXBhY3QtaW52ZXN0aW5nL2RvYy9jb3Jwb3JhdGUtZ292ZXJuYW5jZS1hbmQtcHJveHktdm90aW5nLXBvbGljeS1wcm9jZWR1cmVzLTIwMjEucGRm/corporate-governance-and-proxy-voting-policy-procedures-2021.pdf And many others. If you’re not sure about your financial institution, ask them. Ask how they handle Proxy Voting. Do they outsource to a company like ISS? Be sure to add their answer to the comments below, so we can all share.

If you don’t want Proxy Voting, collect your votes yourself and vote better. It will seem strange at first, for anyone unfamiliar with the process, but it’s actually quick and easy. Add in our suggestion to build your own portfolio instead of turning it over to (woke) managers, and you’ll REALLY have something to be proud of. Plus, you’ll shift from endless management fees to easy-to-understand transaction costs.

What about your current investments?

The next time you receive an IRA statement in the mail, or review your 401(k) or 403(b), remember these tricks:

Open Morningstar.com and type in the name or ticker symbol of any of your investments. If it’s a mutual fund, the ticker symbol will be five letters, ending with an “X”. Then click on the Portfolio tab and scroll down a bit, you’ll see a list of the top holdings, as of their most recent reporting to Morningstar.

Those companies vote on things, like their Board of Directors and whether or not to do DEI things to the company.

While you’re in Morningstar, type in the name or ticker symbol of a company you want to investigate. In this case, Costco Wholesale Corp (COST is their ticker symbol), then click on the Ownership tab. Scroll down and you’ll see a list like the one copied/pasted above, showing the largest Institutional Owners.

Talk to your employer about adding Self-Directed Brokerage Accounts (“SDBA”) to your workplace retirement plan. If you run into trouble, look back through some old episodes where I talk about adding this to 401(k) Plans and why it’s not the big deal some benefits people think it is.

Track down your voting rights and try your best to exercise them in ways that match your value system. I’m assuming you’re not Marxist, anti-West, anti-Capitalism, and disagree with mandated racism.

If any of this seems intimidating, don’t worry, there are a lot of people to help you.

We formed the Financial PMA to help with this; it’s a sounding-board group of like-minded people helping each other to jettison the woke, exploring and finding better answers. Coupled with our research, it’s designed to be a great resource for the Awake. There’s a fee to join, but don’t worry, you should expect to make up that nominal fee by ditching management fees.

You can certainly do this on your own. Watch our how-to videos, follow the links, and apply however and wherever you’d like. Our mission is to help everyone DIS the Globalist Left; know where you Donate, Invest, or Spend your money.

There are Financial Advisors who aren’t woke, and know about the importance of Proxy Voting. Matt & Drew from Inspire Advisors (no affiliation, but UnWoke does make something if you work with them) talk about this here, in their most recent interview.

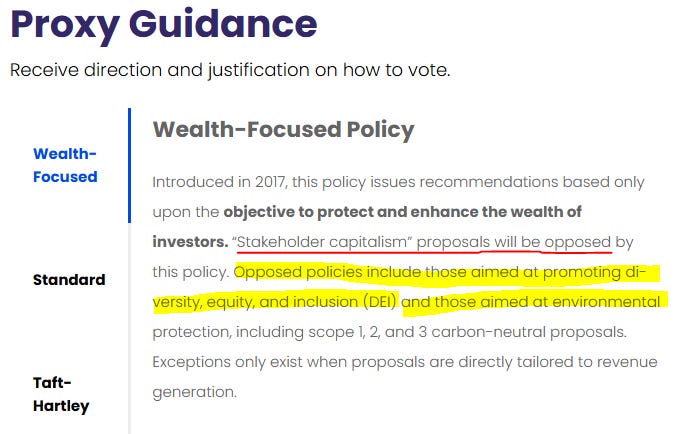

Final note: this looks promising from Proxy Voting company Egan-Jones. This is not a recommendation, merely an observation at this point. We plan to check in with other friendly faces in the financial world. The fact that they even mention ignoring misleading and manipulative practices like ESG and DEI on their website seems like a significant step. As of this writing, we know little about them, but have reached out in an effort to learn more. Stay tuned to UnWoke.Academy.

So for those of us whose investments are Unwoke, our only recourse is to boycott Costco? That truly sucks. Grocery options are already limited. Oh well...Another one bites the dust.

Boycotting can be effective, and I certainly encourage it, whenever and wherever any company is misbehaving. We The People should be much more vigilant about insisting upon corporate behaviors that match out value system. However, know that there are some in Finance who've learned to twist and manipulate things in disruptive ways... especially where billions of dollars are concerned.