I stumbled upon the following post on social media and thought it very telling of the times. Namely, we’re in a prolonged period of acknowledgement mixed with steady doses of “I Told You So”.

Borrowing from Dr. Waters:

We within the financial profession must start to have a long hard look at why so many deliberately went against U.S. interests, freedom, liberty, and Western values, ignored fundamentals, and sold nearly everyone into a Globalist Mega-Cap bubble. This was acting in a purely self-interested psychopathic manner. The facts are coming out.

In 2008 I got myself in hot water for calling out the practice of loading Blackrock funds in pensions. The letter I wrote, spelling out the issue, lead to the end of my direct involvement on Wall Street. I suppose it was my “Jerry McGuire” moment.

Through the years of UnWoke.Academy, I've talked to hundreds (thousands?) of financial professionals who know that their clients are being invested in things harm them and us (collectively). Most said that they don't agree with the "woke" investments but felt powerless to question their bosses. They feared for their jobs if they challenged Big-Box Finance they tell me. I fear for the future of mankind if they don't. A few were, and likely are, oblivious, simply happy to follow orders. And fewer still know what’s being done to the world’s financial ecosystem and are perfectly happy so long as their sales are easy and they make a lot of money.

For a prime example of the harm done by not caring what people are exposed to, check out this May 2024 interview with Justin Bernier from National Security Index:

And for more on the bubble, check out What is the Globalist Bubble:

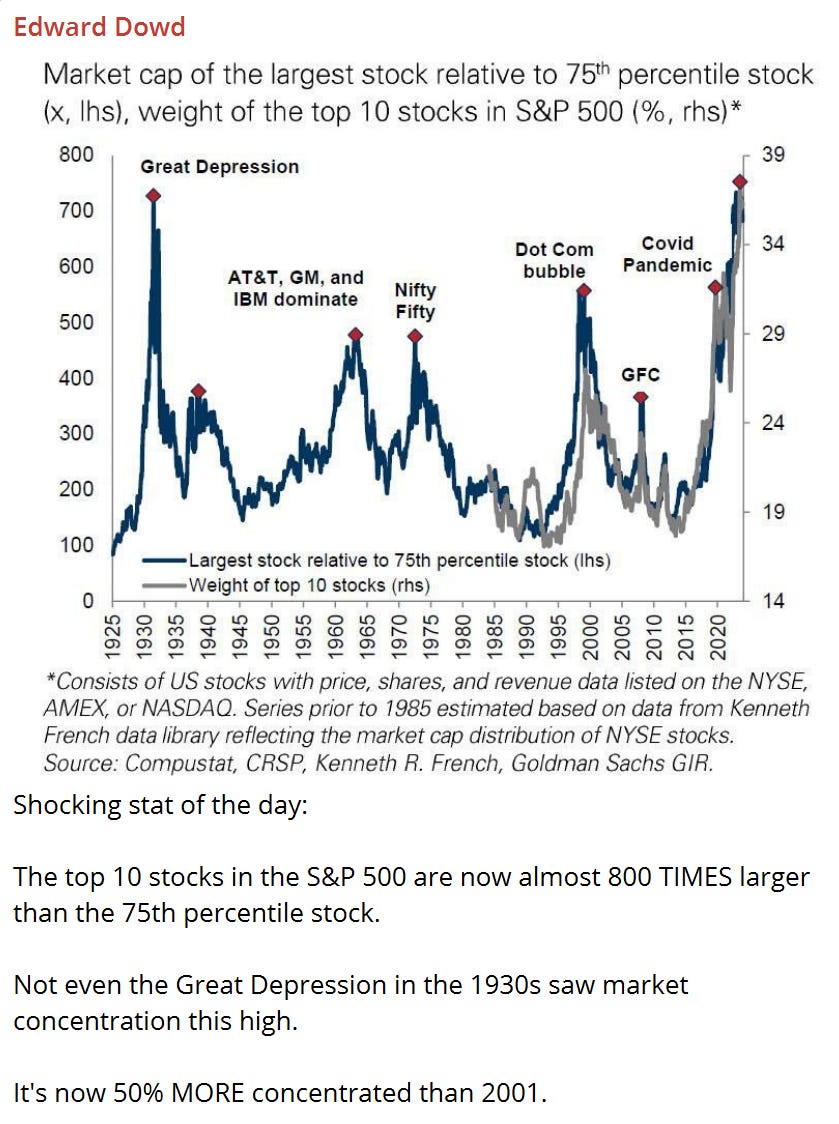

For another perspective on the Globalist Mega-Cap Bubble, here’s Ed Dowd:

![Justin Bernier from National Security Index joins UnWoke [updated, version 2 release - FULL]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-video.s3.amazonaws.com%2Fvideo_upload%2Fpost%2F144518534%2F6c006b66-ed0e-4731-8357-84aa4045babf%2Ftranscoded-1715375290.png)